Can You Link Multiple Bank Accounts to Cash App? A Comprehensive Guide

Cash App has revolutionized how we handle peer-to-peer payments, making it incredibly easy to send and receive money. One common question users often have is: Can you link multiple bank accounts to Cash App? The answer is a bit nuanced, and this comprehensive guide will walk you through everything you need to know about managing multiple bank accounts on Cash App.

Understanding Cash App’s Bank Linking Policy

Cash App allows users to link various financial accounts to their profile for seamless transactions. While it offers flexibility, there are certain limitations and best practices to keep in mind. Let’s delve into the specifics of linking multiple bank accounts.

How Many Bank Accounts Can You Link?

Cash App officially allows you to link one bank account at a time. This means you can’t directly connect multiple bank accounts simultaneously to your Cash App account. However, there are workarounds and alternative methods to manage funds from different accounts, which we will explore further.

Why the Limitation?

The limitation on linking multiple bank accounts is primarily for security and regulatory compliance. By restricting the number of linked accounts, Cash App can better monitor transactions and prevent fraudulent activities. This also helps them comply with various financial regulations and reporting requirements.

Workarounds and Alternatives for Managing Multiple Bank Accounts

While you can’t directly link multiple bank accounts, here are some strategies to effectively manage funds from different accounts using Cash App:

Using a Centralized Bank Account

One of the most straightforward solutions is to use a single bank account as a central hub. You can transfer funds from your other bank accounts to this main account and then link that account to Cash App. This approach simplifies fund management and keeps your Cash App transactions streamlined.

Leveraging Multiple Cash App Accounts

Although not ideal for everyone, creating multiple Cash App accounts (if permitted by Cash App’s terms of service and while adhering to all legal and ethical guidelines) is another workaround. Each account can be linked to a different bank account. However, this method requires careful management and is subject to Cash App’s policies regarding multiple accounts.

Utilizing Debit Cards

Cash App allows you to link multiple debit cards to your account. If you have debit cards associated with different bank accounts, you can add them to your Cash App profile. This allows you to fund transactions using the specific debit card linked to the desired bank account. This is a practical way to bypass the single bank account limitation.

Third-Party Money Transfer Services

Consider using third-party money transfer services like PayPal, Venmo, or Zelle. These platforms often allow you to link multiple bank accounts and can serve as intermediaries for transferring funds to your Cash App account. You can transfer money from one of your bank accounts to the third-party service and then send it to your Cash App account.

Step-by-Step Guide: Linking and Unlinking Bank Accounts on Cash App

To ensure you’re managing your bank accounts effectively on Cash App, here’s a detailed guide on how to link and unlink accounts:

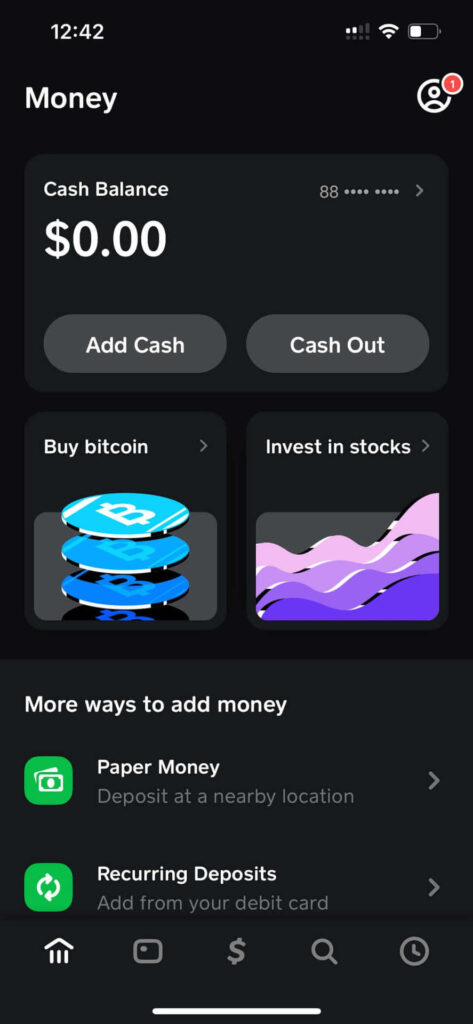

Linking a Bank Account

- Open the Cash App on your smartphone.

- Tap the profile icon (usually a silhouette or your profile picture) in the top-right corner.

- Scroll down and select “Linked Banks.”

- Tap “Link Bank.”

- Follow the on-screen instructions to link your bank account. You may need to enter your bank’s routing number and account number, or use your online banking credentials for instant verification.

- Verify your account using the method provided by Cash App (e.g., micro-deposits).

Unlinking a Bank Account

- Open the Cash App on your smartphone.

- Tap the profile icon in the top-right corner.

- Scroll down and select “Linked Banks.”

- Tap on the bank account you want to unlink.

- Select “Remove Bank.”

- Confirm your decision to unlink the account.

Troubleshooting Common Bank Linking Issues

Sometimes, you might encounter issues while linking your bank account to Cash App. Here are some common problems and how to troubleshoot them:

Incorrect Bank Details

Ensure you’ve entered the correct routing number and account number. Double-check this information with your bank to avoid errors.

Account Verification Problems

If you’re having trouble verifying your account, check your bank statements for the micro-deposits sent by Cash App. Enter the exact amounts to complete the verification process. If the micro-deposits don’t appear, contact Cash App support.

Bank Restrictions

Some banks may have restrictions on linking to third-party apps like Cash App. Contact your bank to inquire about any such restrictions and request assistance if needed.

Cash App System Errors

Occasionally, Cash App may experience system errors that prevent you from linking your bank account. Check Cash App’s status page or social media channels for updates. If there’s a known issue, wait for it to be resolved and try again later.

Security Best Practices for Linking Bank Accounts to Cash App

When linking your bank account to Cash App, prioritize security to protect your financial information:

Use Strong Passwords

Create a strong, unique password for your Cash App account and your linked bank accounts. Avoid using easily guessable information like your birthday or name.

Enable Two-Factor Authentication

Enable two-factor authentication (2FA) on your Cash App account for an extra layer of security. This requires a verification code from your phone or email in addition to your password when logging in.

Monitor Your Transactions

Regularly monitor your Cash App transactions and bank statements for any unauthorized activity. Report any suspicious transactions to Cash App and your bank immediately.

Keep Your App Updated

Ensure you’re using the latest version of the Cash App to benefit from the latest security updates and bug fixes.

The Future of Bank Linking on Cash App

As Cash App continues to evolve, it’s possible that they may introduce support for linking multiple bank accounts directly in the future. Keep an eye on Cash App’s official announcements and updates for any changes to their bank linking policy. For now, understanding the current limitations and utilizing the workarounds mentioned above can help you effectively manage your funds across different accounts.

Conclusion

While Cash App currently restricts users to linking only one bank account at a time, there are several effective strategies to manage funds from multiple accounts. Whether you choose to use a centralized bank account, leverage debit cards, or explore third-party services, understanding your options is key. By following the steps outlined in this guide and prioritizing security, you can make the most of Cash App’s convenient payment features while keeping your financial information safe. Remember to always stay informed about Cash App’s policies and updates to ensure a smooth and secure experience. Hopefully, this article has answered your query, can you link multiple bank accounts to Cash App, and provided you with actionable solutions.

Cash App’s functionality and user experience are constantly being refined, reflecting their commitment to providing seamless financial services. Knowing the ins and outs of the platform, including its limitations on linking multiple bank accounts, empowers users to leverage its features effectively. Using workarounds and security best practices, you can navigate the financial landscape with confidence. If you’re considering alternative methods to manage funds, remember to evaluate the pros and cons of each approach to find the best fit for your needs. Ultimately, staying informed and proactive is crucial for a secure and efficient Cash App experience. The ability to link multiple bank accounts to Cash App directly may be a feature in the future, but for now, these alternatives offer viable solutions.

It is important to note that policies and features on Cash App, including those related to linking multiple bank accounts, are subject to change. Always refer to the official Cash App resources and support channels for the most current information. The options for linking multiple bank accounts may evolve, so staying updated is crucial. [See also: Cash App Direct Deposit Guide] [See also: How to Increase Cash App Limit] [See also: Cash App Security Tips]